Bitcoin, the world's first decentralized digital currency, has become a focal point for investors and traders alike. Its volatile nature and potential for high returns have sparked widespread interest in understanding its market trends. FintechZoom, a leading financial technology platform, offers valuable insights into Bitcoin stock predictions, helping investors make informed decisions. As the cryptocurrency market continues to evolve, staying updated with reliable predictions is crucial for maximizing returns and mitigating risks. This article delves into FintechZoom's Bitcoin stock predictions, providing you with expert analysis and actionable insights.

Investing in Bitcoin is not just about luck; it requires a strategic approach backed by data-driven insights. FintechZoom's platform leverages advanced algorithms and market analysis to forecast Bitcoin's price movements. Whether you're a seasoned investor or a newcomer to the crypto space, understanding these predictions can significantly enhance your investment strategy. By the end of this article, you'll have a comprehensive understanding of how FintechZoom's predictions work and how you can use them to your advantage.

In this article, we will explore the various factors influencing Bitcoin's price, FintechZoom's methodology for making predictions, and expert opinions on the future of Bitcoin. We'll also provide practical tips for investors and address frequently asked questions about Bitcoin stock predictions. By following this guide, you'll be better equipped to navigate the complexities of the cryptocurrency market and make decisions that align with your financial goals.

Read also:Shane Myler A Comprehensive Guide To The Rising Star

Table of Contents

- Understanding Bitcoin Stock Predictions

- FintechZoom's Methodology for Bitcoin Predictions

- Factors Influencing Bitcoin Price Movements

- Historical Performance of Bitcoin

- Expert Opinions on Bitcoin's Future

- Tips for Investing in Bitcoin Based on Predictions

- Risks and Challenges in Bitcoin Investment

- Long-Term Outlook for Bitcoin

- Frequently Asked Questions About Bitcoin Stock Predictions

- Conclusion and Call to Action

Understanding Bitcoin Stock Predictions

Bitcoin stock predictions are forecasts about the future price movements of Bitcoin, based on historical data, market trends, and other influencing factors. These predictions are essential for investors looking to capitalize on the cryptocurrency's volatility. By analyzing patterns and trends, platforms like FintechZoom aim to provide insights into potential price changes, helping investors make informed decisions.

There are several methods used to predict Bitcoin's price, including technical analysis, fundamental analysis, and sentiment analysis. Technical analysis involves studying price charts and identifying patterns that indicate future price movements. Fundamental analysis, on the other hand, looks at the intrinsic value of Bitcoin by examining factors such as its adoption rate, regulatory environment, and technological advancements. Sentiment analysis gauges market sentiment by analyzing social media trends, news articles, and other public sentiments.

Types of Bitcoin Predictions

- Short-Term Predictions: Focus on price movements within days or weeks. These are useful for day traders and short-term investors.

- Medium-Term Predictions: Cover price trends over several months. These are ideal for swing traders and medium-term investors.

- Long-Term Predictions: Analyze price movements over years. These are suited for long-term investors and institutional players.

FintechZoom's Methodology for Bitcoin Predictions

FintechZoom employs a sophisticated methodology to provide accurate Bitcoin stock predictions. Their approach combines advanced algorithms, machine learning, and expert analysis to generate forecasts. By leveraging big data and real-time market information, FintechZoom ensures that their predictions are both timely and reliable.

One of the key components of FintechZoom's methodology is the use of machine learning models. These models analyze vast amounts of historical data to identify patterns and trends that may not be immediately apparent. By continuously learning from new data, these models adapt to changing market conditions, improving their accuracy over time.

Data Sources and Analysis

- Historical Data: FintechZoom uses historical price data to identify long-term trends and patterns.

- Market Sentiment: Social media trends, news articles, and public sentiment are analyzed to gauge market mood.

- Technical Indicators: Tools like moving averages, RSI, and MACD are used to predict short-term price movements.

Factors Influencing Bitcoin Price Movements

Several factors influence Bitcoin's price movements, ranging from macroeconomic conditions to technological advancements. Understanding these factors is crucial for interpreting Bitcoin stock predictions accurately.

One of the primary drivers of Bitcoin's price is market demand. As more individuals and institutions adopt Bitcoin, its value tends to increase. Conversely, negative news or regulatory crackdowns can lead to a decline in demand, causing the price to drop. Additionally, macroeconomic factors such as inflation, interest rates, and geopolitical events can impact Bitcoin's price by influencing investor sentiment.

Read also:Mariana Luccon Age A Comprehensive Guide To Her Life And Career

Key Influencing Factors

- Regulatory Changes: Government regulations can significantly impact Bitcoin's adoption and price.

- Technological Advancements: Upgrades to Bitcoin's blockchain, such as the implementation of the Lightning Network, can enhance its utility and drive up demand.

- Market Sentiment: Positive or negative news can sway investor sentiment, influencing buying and selling behavior.

Historical Performance of Bitcoin

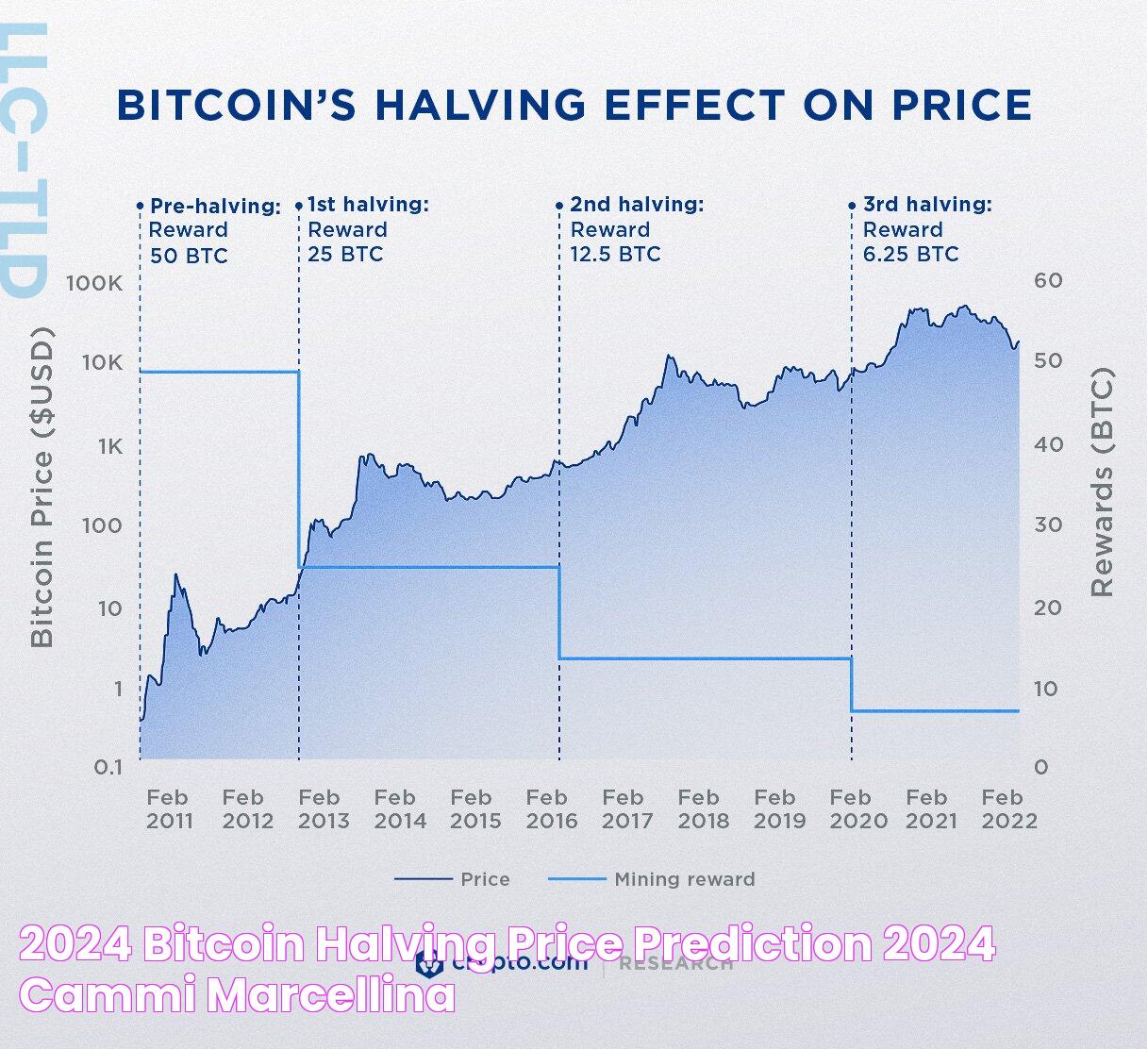

Bitcoin's historical performance provides valuable insights into its potential future movements. Since its inception in 2009, Bitcoin has experienced significant price volatility, with periods of rapid growth followed by sharp declines.

For instance, in 2017, Bitcoin's price surged from around $1,000 to nearly $20,000, driven by increased media attention and investor interest. However, the following year saw a significant correction, with the price dropping below $4,000. Despite these fluctuations, Bitcoin has consistently shown resilience, recovering from downturns and reaching new all-time highs.

Major Price Milestones

- 2010: Bitcoin's first recorded price was $0.003 on the BitcoinMarket.com exchange.

- 2013: Bitcoin surpassed $1,000 for the first time.

- 2017: Bitcoin reached its peak of nearly $20,000.

- 2021: Bitcoin hit a new all-time high of over $64,000.

Expert Opinions on Bitcoin's Future

Experts in the financial and cryptocurrency sectors have varying opinions on Bitcoin's future. Some believe that Bitcoin will continue to grow in value, potentially reaching new all-time highs, while others are more cautious, citing regulatory risks and market volatility.

For example, Cathie Wood, CEO of ARK Invest, has been a vocal proponent of Bitcoin, predicting that its price could reach $1 million by 2030. On the other hand, Nouriel Roubini, an economist known for his bearish views on cryptocurrencies, has expressed skepticism about Bitcoin's long-term viability, citing its lack of intrinsic value and regulatory challenges.

Notable Expert Predictions

- Cathie Wood: Predicts Bitcoin could reach $1 million by 2030.

- Nouriel Roubini: Skeptical about Bitcoin's long-term prospects.

- Michael Saylor: CEO of MicroStrategy, believes Bitcoin is a superior store of value compared to traditional assets.

Tips for Investing in Bitcoin Based on Predictions

Investing in Bitcoin based on predictions requires a strategic approach. Here are some practical tips to help you make informed investment decisions:

First, diversify your portfolio. While Bitcoin can offer high returns, it's essential to balance your investments with other assets to mitigate risks. Consider allocating a portion of your portfolio to stablecoins or traditional assets like stocks and bonds.

Additional Investment Tips

- Stay Informed: Keep up with the latest news and developments in the cryptocurrency market.

- Set Clear Goals: Define your investment objectives and risk tolerance before investing.

- Use Dollar-Cost Averaging: Invest a fixed amount regularly to reduce the impact of market volatility.

Risks and Challenges in Bitcoin Investment

While Bitcoin offers lucrative opportunities, it also comes with significant risks and challenges. One of the primary risks is its price volatility. Bitcoin's price can fluctuate dramatically in a short period, leading to potential losses for investors.

Regulatory risks are another concern. Governments worldwide are still grappling with how to regulate cryptocurrencies, and new regulations could impact Bitcoin's adoption and price. Additionally, security risks such as hacking and fraud pose threats to investors, highlighting the importance of using secure wallets and exchanges.

Common Risks

- Price Volatility: Bitcoin's price can change rapidly, leading to potential losses.

- Regulatory Risks: New regulations could impact Bitcoin's adoption and price.

- Security Risks: Hacking and fraud are significant concerns in the cryptocurrency space.

Long-Term Outlook for Bitcoin

The long-term outlook for Bitcoin remains optimistic, with many experts predicting continued growth. As more institutions adopt Bitcoin and integrate it into their financial systems, its value is likely to increase. Additionally, advancements in blockchain technology and increased regulatory clarity could further boost Bitcoin's adoption.

However, it's essential to remain cautious and consider the potential challenges ahead. Regulatory changes, technological setbacks, and market sentiment can all impact Bitcoin's future. By staying informed and adopting a strategic approach, investors can navigate these challenges and capitalize on Bitcoin's potential.

Frequently Asked Questions About Bitcoin Stock Predictions

What are Bitcoin stock predictions? Bitcoin stock predictions are forecasts about the future price movements of Bitcoin, based on historical data, market trends, and other influencing factors.

How accurate are FintechZoom's Bitcoin predictions? FintechZoom's predictions are based on advanced algorithms and expert analysis, making them relatively accurate. However, it's important to remember that no prediction can guarantee future results.

What factors influence Bitcoin's price? Factors such as market demand, regulatory changes, technological advancements, and macroeconomic conditions can influence Bitcoin's price.

Conclusion and Call to Action

In conclusion, understanding FintechZoom's Bitcoin stock predictions can provide valuable insights for investors looking to navigate the cryptocurrency market. By leveraging advanced algorithms and expert analysis, FintechZoom offers reliable forecasts that can help you make informed investment decisions.

As you embark on your investment journey, remember to stay informed, diversify your portfolio, and adopt a strategic approach. If you found this article helpful, please consider sharing it with others who might benefit from these insights. Additionally, feel free to leave a comment or explore other articles on our site for more valuable information. Happy investing!