What does AFLAC do? This is a common question for those exploring supplemental insurance options. AFLAC, short for American Family Life Assurance Company, is a well-known name in the insurance industry, offering unique financial protection solutions to individuals and families. Unlike traditional health insurance, AFLAC provides supplemental coverage that helps policyholders manage out-of-pocket expenses related to medical treatments, accidents, and critical illnesses. With its innovative approach to insurance, AFLAC has become a trusted name for millions of people worldwide.

Founded in 1955, AFLAC has grown to become a global leader in voluntary insurance products. The company operates primarily in the United States and Japan, where it serves over 50 million policyholders. Its mission is to provide financial peace of mind by offering policies that complement primary health insurance plans. AFLAC's offerings are designed to ease the financial burden caused by unexpected medical events, ensuring that individuals and families can focus on recovery without worrying about expenses.

In this article, we will explore what AFLAC does in detail, including its history, product offerings, and the benefits it provides to policyholders. We will also discuss how AFLAC stands out in the insurance industry and why it is considered a reliable choice for supplemental coverage. Whether you are considering purchasing an AFLAC policy or simply want to understand its role in the insurance landscape, this guide will provide you with all the information you need.

Read also:Chris Pratt Wife A Comprehensive Look At His Love Life And Family

Table of Contents

- History and Background of AFLAC

- Core Products Offered by AFLAC

- Accident Insurance: What Does AFLAC Do for Policyholders?

- Critical Illness Insurance: A Key Offering

- Hospital Indemnity Insurance Explained

- Benefits of Choosing AFLAC

- AFLAC vs. Traditional Health Insurance

- AFLAC's Global Impact and Reputation

- How to Apply for AFLAC Insurance

- Conclusion: Why Choose AFLAC?

History and Background of AFLAC

AFLAC was founded in 1955 by three brothers: John, Paul, and Bill Amos. The company began with a simple yet powerful vision: to provide financial protection to families during times of medical need. Initially operating as a small insurance provider in Columbus, Georgia, AFLAC quickly expanded its reach and product offerings. Today, it is a Fortune 500 company with a strong presence in both the United States and Japan.

One of the key milestones in AFLAC's history was its introduction of cancer insurance in 1958. This product was revolutionary at the time, as it provided financial support to individuals diagnosed with cancer, covering expenses such as treatments, hospital stays, and lost income. Over the years, AFLAC has continued to innovate, introducing policies for accident insurance, critical illness insurance, and hospital indemnity insurance.

AFLAC's commitment to excellence has earned it numerous accolades. The company has been consistently ranked among the most ethical companies in the world by the Ethisphere Institute. Additionally, AFLAC is known for its strong corporate social responsibility initiatives, including its support for cancer research and treatment programs.

Core Products Offered by AFLAC

AFLAC offers a wide range of supplemental insurance products designed to provide financial protection in various scenarios. These products are tailored to meet the needs of individuals and families, ensuring that they are prepared for unexpected medical events. Below are some of the core products offered by AFLAC:

- Accident Insurance: Covers costs related to accidental injuries, such as emergency room visits, surgeries, and physical therapy.

- Critical Illness Insurance: Provides lump-sum payments for diagnoses of serious illnesses like cancer, heart attack, and stroke.

- Hospital Indemnity Insurance: Offers daily cash benefits for hospital stays, surgeries, and other medical procedures.

- Short-Term Disability Insurance: Replaces a portion of lost income during temporary periods of disability.

Accident Insurance: What Does AFLAC Do for Policyholders?

Accident insurance is one of AFLAC's most popular products, and for good reason. This type of coverage is designed to help policyholders manage the financial impact of accidental injuries. Whether it's a broken bone, a car accident, or a sports-related injury, AFLAC's accident insurance provides cash benefits to cover out-of-pocket expenses.

The benefits of AFLAC's accident insurance include:

Read also:Noa Argamani Boyfriend Dead Unveiling The Truth Behind The Tragic Story

- Reimbursement for medical expenses such as X-rays, MRIs, and surgeries.

- Coverage for ambulance rides and emergency room visits.

- Financial support for recovery-related costs, such as physical therapy and rehabilitation.

Who is Eligible for Accident Insurance?

AFLAC's accident insurance is available to individuals of all ages, making it a versatile option for families, working professionals, and retirees. The policy can be purchased as a standalone product or as part of an employer-sponsored benefits package. Premiums are generally affordable, and coverage can be customized to meet individual needs.

Critical Illness Insurance: A Key Offering

Critical illness insurance is another cornerstone of AFLAC's product lineup. This type of policy provides a lump-sum payment upon the diagnosis of a covered critical illness, such as cancer, heart attack, or stroke. The funds can be used for medical expenses, household bills, or any other financial needs that arise during treatment and recovery.

One of the key advantages of AFLAC's critical illness insurance is its flexibility. Policyholders can use the cash benefit however they see fit, whether it's to cover deductibles, pay for experimental treatments, or replace lost income. This flexibility makes critical illness insurance an invaluable safety net for individuals and families.

Hospital Indemnity Insurance Explained

Hospital indemnity insurance is designed to provide financial support during hospital stays. AFLAC's hospital indemnity insurance offers daily cash benefits for each day a policyholder is admitted to the hospital, as well as additional payments for surgeries, intensive care, and other medical procedures.

This type of coverage is particularly beneficial for individuals with high-deductible health plans, as it helps offset the costs of hospitalization. By providing a steady stream of income during a hospital stay, AFLAC's hospital indemnity insurance ensures that policyholders can focus on recovery without worrying about financial strain.

Benefits of Choosing AFLAC

Choosing AFLAC for supplemental insurance comes with numerous advantages. Here are some of the key benefits that set AFLAC apart from other insurance providers:

- Comprehensive Coverage: AFLAC's policies are designed to complement primary health insurance, providing additional financial protection.

- Flexible Payment Options: Policyholders can customize their coverage and payment plans to suit their budget and needs.

- Quick Claims Processing: AFLAC is known for its efficient claims process, ensuring that policyholders receive their benefits promptly.

- Global Reach: With operations in the U.S. and Japan, AFLAC serves millions of policyholders worldwide.

AFLAC vs. Traditional Health Insurance

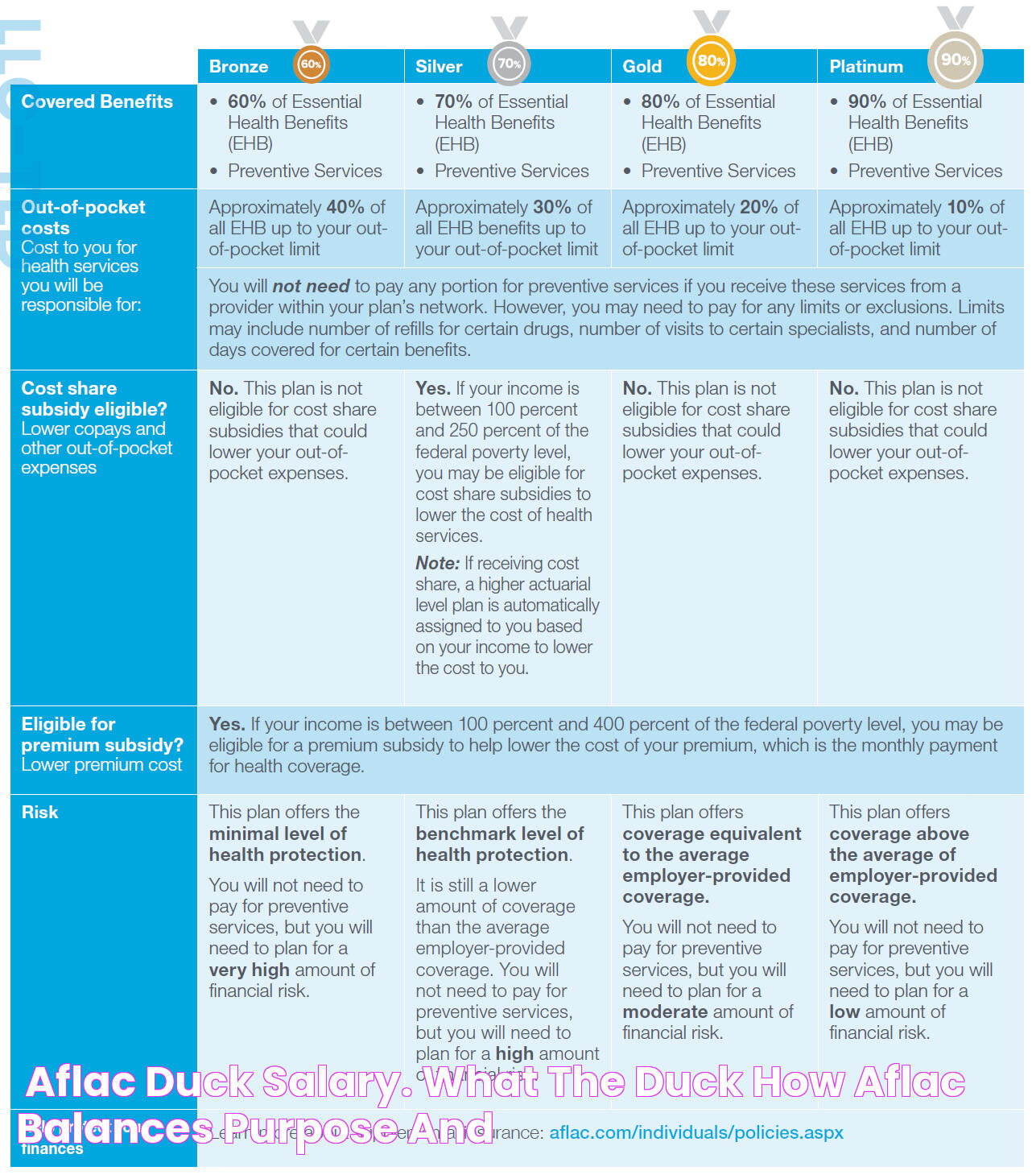

While traditional health insurance focuses on covering medical expenses, AFLAC's supplemental insurance provides financial support for out-of-pocket costs. This distinction is crucial, as many individuals find themselves burdened by expenses that are not fully covered by their primary insurance plans.

For example, traditional health insurance may cover a portion of hospital bills, but it does not account for lost income during recovery. AFLAC's policies, on the other hand, offer cash benefits that can be used to replace lost wages, pay for household expenses, or cover deductibles. This makes AFLAC an excellent complement to traditional health insurance.

AFLAC's Global Impact and Reputation

AFLAC's influence extends beyond the insurance industry. The company is committed to making a positive impact on society through its corporate social responsibility initiatives. One of AFLAC's most notable contributions is its support for cancer research and treatment programs.

In addition to its philanthropic efforts, AFLAC is recognized for its ethical business practices. The company has been named one of the World's Most Ethical Companies by the Ethisphere Institute for over a decade. This recognition underscores AFLAC's commitment to transparency, integrity, and trustworthiness.

How to Apply for AFLAC Insurance

Applying for AFLAC insurance is a straightforward process. Individuals can purchase policies directly from AFLAC or through their employer's benefits program. Here are the steps to apply:

- Visit AFLAC's official website to explore available products.

- Contact an AFLAC representative to discuss your needs and options.

- Complete the application form and submit it along with any required documentation.

- Review your policy details and make the first premium payment.

Employer-Sponsored Plans

Many employers offer AFLAC insurance as part of their benefits package. This allows employees to enjoy discounted rates and convenient payroll deductions. If your employer offers AFLAC, consider enrolling during the open enrollment period to take advantage of these benefits.

Conclusion: Why Choose AFLAC?

In conclusion, what does AFLAC do is provide essential supplemental insurance products that offer financial peace of mind to individuals and families. From accident insurance to critical illness coverage, AFLAC's offerings are designed to ease the financial burden of unexpected medical events. With its commitment to excellence, ethical practices, and global impact, AFLAC has earned a reputation as a trusted insurance provider.

If you're considering supplemental insurance, AFLAC is an excellent choice. Its comprehensive coverage, flexible options, and quick claims process make it a standout in the industry. Take the first step toward financial security by exploring AFLAC's products today. Share this article with friends and family to help them understand the benefits of AFLAC, or leave a comment below to share your thoughts and experiences.